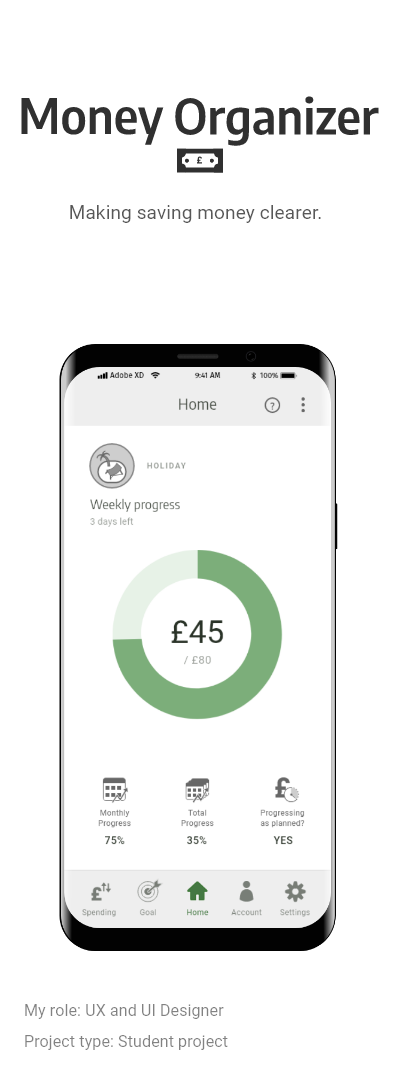

Money Organizer is a money saving app.

- it gives to the users an overview of their finances

- it allows users to create a saving goal and show its progress

- it raises awareness on how the money is spent and what actions could help the users save more money

- it motivates the user through positive feedback, ratings and competition* (advanced mode only), transforming a stressful experience such as managing your finances into a fun challenge.

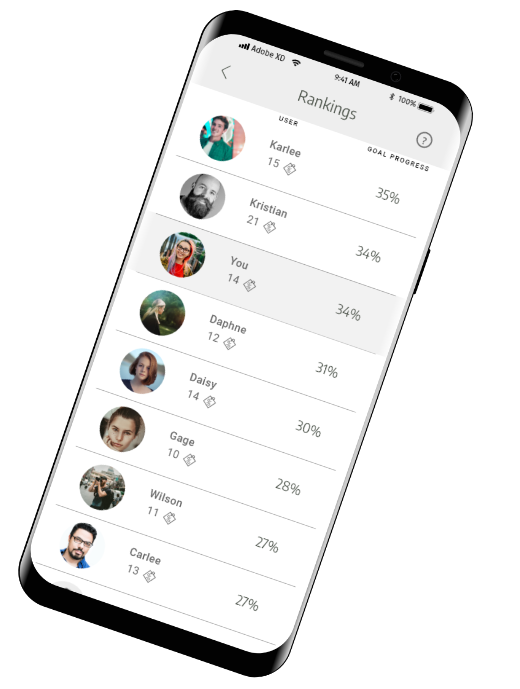

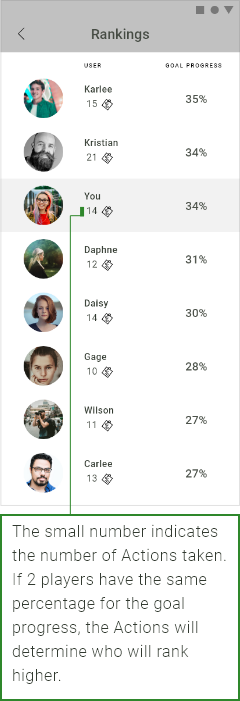

* The app algorithms allow users to compete with each other without sharing how much money is spent or saved. The app will only provide to other users progress percentages and the number of the saving actions taken.

Design Process

Create a money saving tool

Users should be guided through the saving process while also having an overview of how their money is spent.

Research

- Wide usage of the pie chart for showing a spending overview by category

- An interesting feature is showing the current subscriptions and allow the user to quickly unsubscribe

- Some apps find better deals for bills and similar

What do users want?

- An intuitive way to see how they spend their money

- Be motivated to save money

Positive feedback and Gamification

I decided to focus on how I could motivate the users to save

money, using gamification.

I believed the core need behind a saving money tool was to

build awareness, discipline, ownership of the process

of saving and give a sense of satisfaction through it.

Positive feedback and a sense of progress seemed essential in

order to replace a possibly negative feeling towards the

process of saving money with a positive one.

During the brainstorming process, I have set down some important rules the app should follow:

- The app should follow the mentality of the glass half full, emphasizing how much the user has already saved instead of punishing for the money that have been spent.

- The app will allow competition between users, in order to motivate the user.

Having competition without sharing financial information

Competitions can motivate users, however creating one in a financing app was pretty challenging. People usually do not share to others their financial details. Therefore sharing quantities of money spent and money saved was not viable. After considering a point system and other similar possible methods, I then have settled down for an easier system with goal progress percentages.

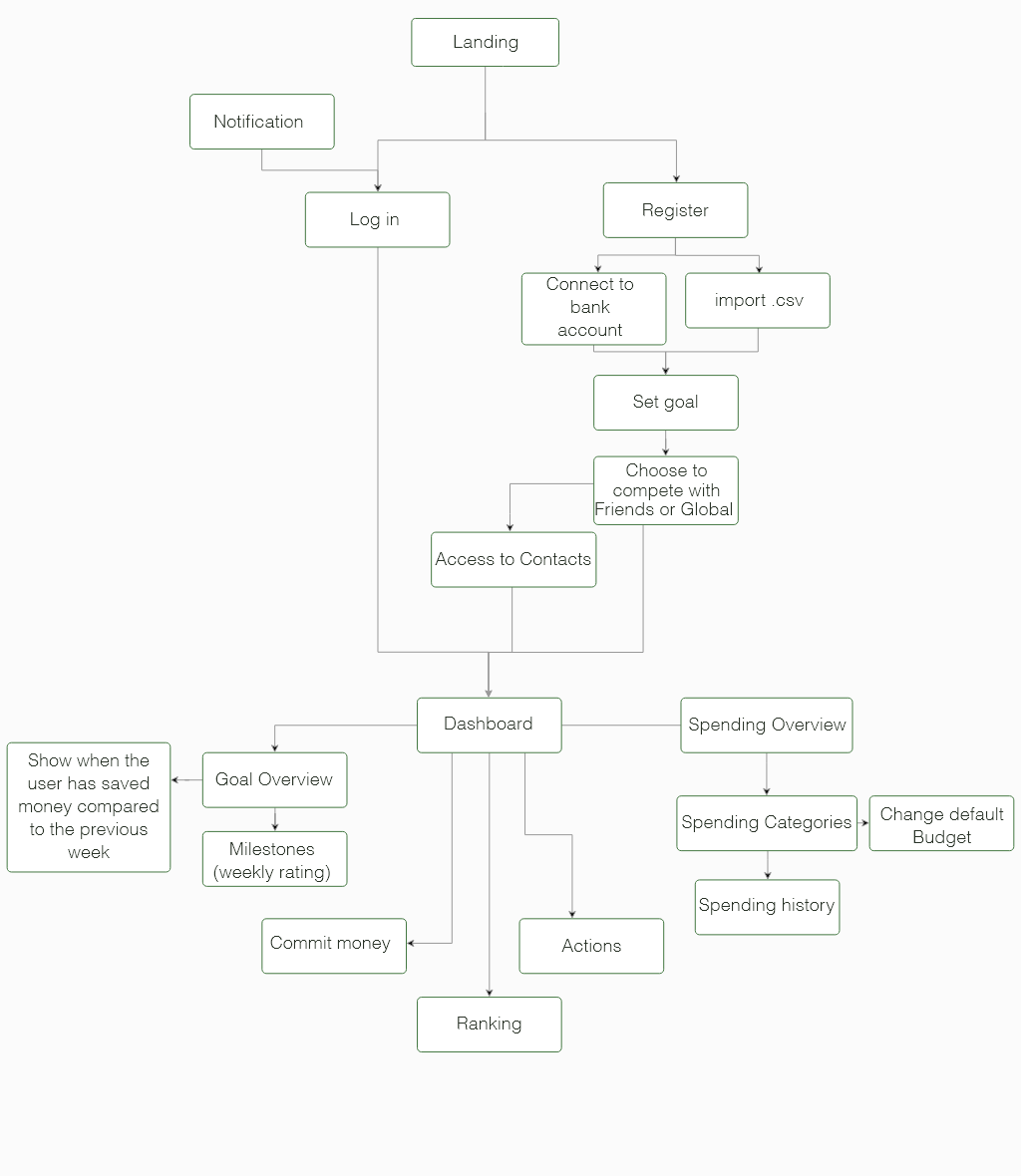

User flow diagram

App unique features

-

Ranking system

The ranking system uses data from all the users the app has ever had. Perhaps the user friends used the app in the past and the data is memorized. The app knows how much they have saved (in percentage) through time. It does not matter the amount of money needed by the goal as only the progress percentage is used for the ranking.

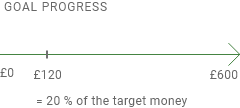

As an example, the user might have a goal of £600 in 100 days, and the user has saved money for 10 days. That means:

The user so far has saved £120, so 20% of the total amount (£600 ).

So in the Ranking page, the user will see his / her friends goal progress and action progress when they were saving for their goal and they were at the same time percentage.

-

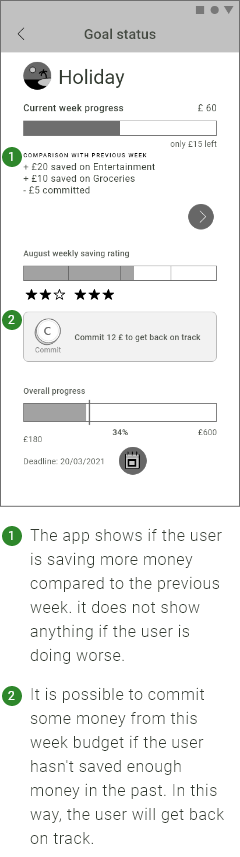

Goal status

Every week gets a star rating:

0 stars: no savings or if the user hasn't saved any money and also used some of the previous savings

low amount of money saved

medium amount of money saved

Weekly target achieved.

S rating: the user has saved more than the weekly target amount.

-

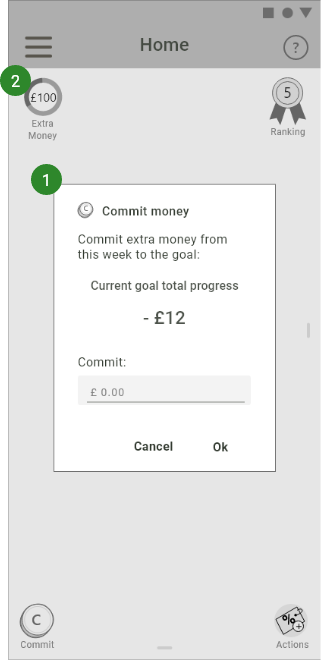

Committing process

If the user hasn't saved enough money in the past, it is possible to commit some money to get back on track.(1)

Those money will get subtracted to the Extra money category.(2)

At the end of the week, the user needs to not have the Extra money value below 0. That way, the weekly rating will be of 3 stars because it means the user has reached the weekly goal and also saved the committed amount of money. The total progress bar will also be back on track.

-

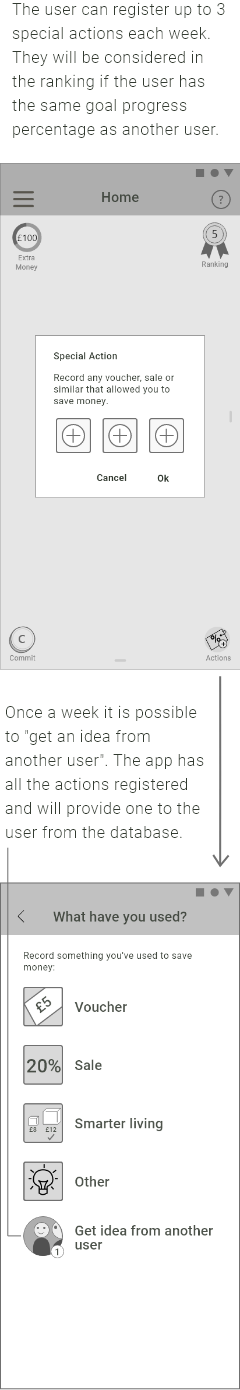

Special actions

-

Saving suggestions

Testing and results

I conducted some usability tests on 3 people using my app

prototype.

The results showed the system of my app was pretty complicated

and not suitable to all users. Therefore, I have decided to

have a Simple mode of the app and an Advanced mode.

I have also added several onboarding screens for the advanced mode:

High fidelity mobile screens

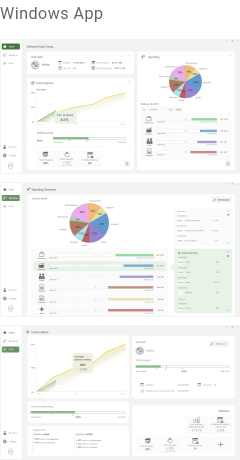

Desktop screens

Takeaway

Through this project I wanted to use my knowledge from my university degree in Games Design to introduce gamification in a FinTech app. After the testing phase, it was pretty obvious most people were used to much simpler gamification experiences. Because of this, I have learnt how sometimes it is good to have different app modes or include some more in-depth features as tertiary buttons in order to create a more flexible experience. Understanding better the usability rules of gamification is very important as it s becoming more and more popular.

Future iterations

A big future iteration would be allowing users to add more than one saving goal. The spending overview bars do not currently show anything about recurring payments (rent or mortgage, subscriptions etc). It could be nice to add a feature showing in black the recurring spending.